Let's work together to get you lower private student loan rates.

We make lenders compete to offer you lower rates

than you can get on your own.

How? Group bargaining power:

- Signup below - no cost, no commitment, no credit check

- Lenders compete for your group’s business

- You get the best offer (for your credit profile)

157,935

members signed up so far

$833.52M+ in loans

secured at low rates

up to 4% lower

for Juno members

Extra Benefits for Members Who Join Before April 30th!

1,199 Juno members

3,008 Juno members

1,256 Juno members

1,201 Juno members

1,465 Juno members

957 Juno members

2,464 Juno members

2,704 Juno members

1,148 Juno members

1,871 Juno members

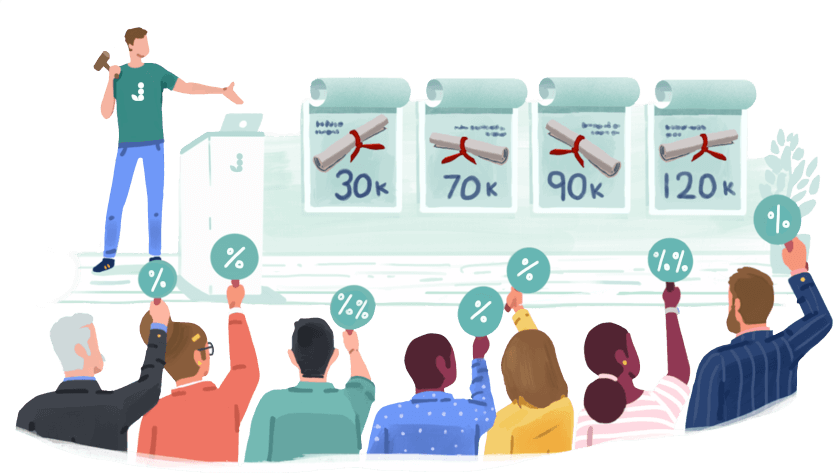

How it Works

We gather large groups of people and get lenders to compete for our business.

BEFORE APRIL 30

You sign up.

Tell us a little bit about yourself and help us grow our negotiating power by spreading the word.

MAY

We run a bid.

Using the power of your voices, we make lenders compete for our collective business.

JUNE

We compare.

We share the negotiated deals with you and you can decide to use it or not.

There’s no commitment.

Why Juno?

Free, Fast and Easy

Signing up is free and takes less than 2 minutes. We don’t run a credit check and don’t need your social security number.

Better Deals

Months of research and the competitive process ensure that our members get the best rates in the market. You’re always free to compare yourself!

Together

Invite those you care about and help the negotiation be successful. The larger the group, the better our chances of success. You'll also get rewarded for helping grow our community.

Transparent

We will keep you informed through the entire process so you can make informed decisions.

Featured Articles

We Are Juno

Recent grads who learned everything you need to know about saving on education costs. We’re always happy to chat, so feel free to send us a note!

High Yield

High Yield